Connecting The Unconnected

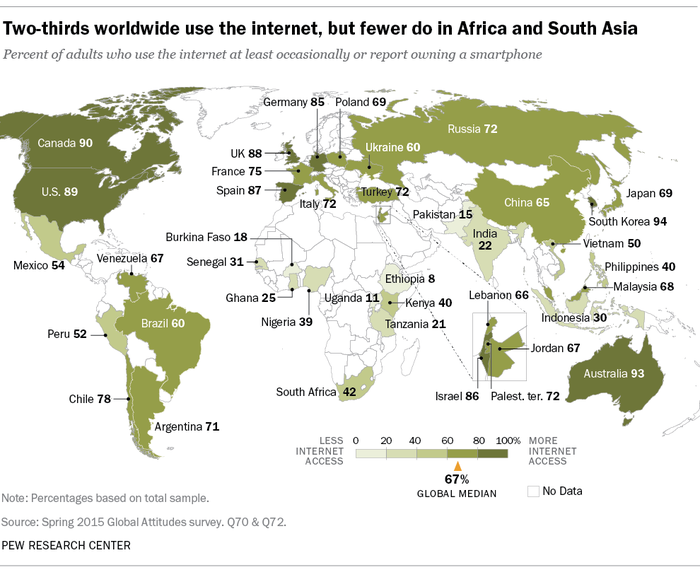

Despite increasing smartphone adoption and escalating data traffic, around 3.7 billion people are yet to begin using the internet. The number mostly pertains to low-income, developing economies. GSMA reports that India and Sub-Saharan Africa account for 42 percent of the world’s unconnected population.

Users in developed economies account for 81 percent of worldwide users, along with higher penetration rates. (Source: ITU).

Source:Pew Research Center

The Device Factor

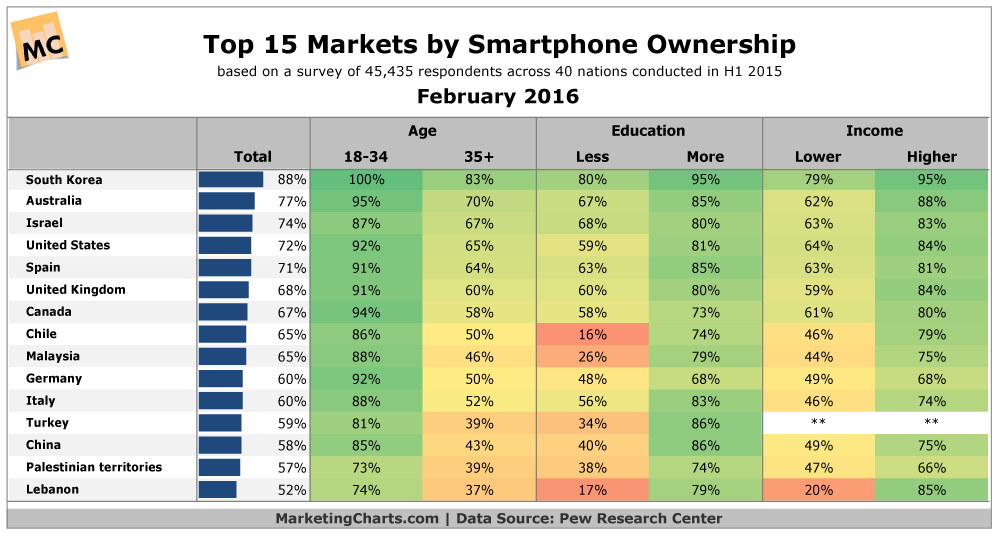

The global distribution of smartphones significantly shapes the percentage of internet penetration across regions. Feature phones continue to have higher market share worldwide as compared to smartphones. There is a better distribution of feature phones across the world because the majority of the population cannot invest in smartphones. According to Strategy Analytics Director Ken Hyers, “Feature phones today still account for one in five of all mobile phones bought worldwide, and the category is surprisingly larger than many think.”

It is mostly the developed economies that have a more significant market share for smartphones. South Korea tops the chart with 88 percent penetration, followed by other affluent economies like Australia, Israel, USA, Spain New Zealand, etc. Emerging markets occupy the lower rungs with less than 50 percent penetration. (Source: Wikipedia)

Source: MarketingCharts

What can we take from the Figures ?

GSMA has categorized the GSMA mobile connectivity index to quantify the barriers to the mobile internet across four key enablers-Infrastructure, Affordability, Consumer Readiness, and Content. With the help of 39 specific indicators feeding into 13 dimensions, the index measures the performance of 150 countries against the key enablers. The analysis helps to uncover the global disparities that exist in terms of internet penetration.

Infrastructur

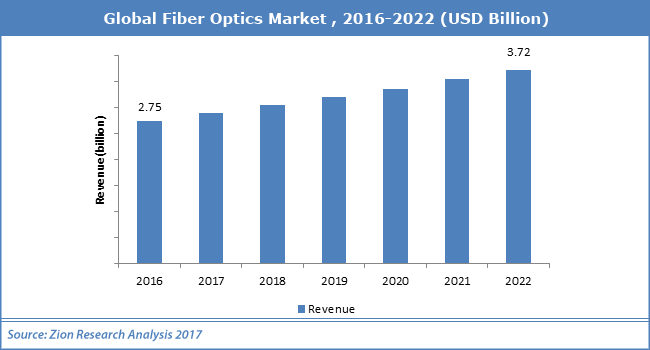

Mobile Infrastructure, network coverage, spectrum, electricity, etc. are indispensable for efficient digital access. Without these components, internet access is a faraway reality. According to the data presented by GSMA, most countries in Sub-Saharan Africa are not using the internet because of insufficient infrastructure at a rate of only 32.1 percent. Affluent economies in Western Europe, North America, and East/South East Asia score highest in terms of infrastructure. High capacity fixed networks; especially optical fiber are a prerequisite for undeterred voice communication and internet connectivity. The optical fiber is reported to have reached internet speeds of over 100 petabit/kilometre per second (Source: Wiki).

However, due to complicated and expensive installation process that the optical network entails, most emerging economies are yet to utilize its potential. Therefore, several countries are still outside the advanced 4G networks because they still rely upon traditional copper networks.

Source: Zion Research Analysis 2017

Affordability

As one of the key enablers, affordability mainly affects digital inclusion. It takes into account various factors like income distribution, taxation, mobile tariffs, and handset price (GSMA) across all regions.

Amongst all these factors, the most pressing one is the affordability of data. Despite increasing mobile subscription with 5 billion subscribers and 2.3 billion smartphone users (GSMA), most people in the emerging markets are not coming online because of relatively expensive data plans. Most data schemes released by network carriers do not deliver the desired value for money. Several users living within a 3G/4G zone own a smartphone without an internet connection because besides being costly, data packages in emerging markets do not meet their requirements.

Consumer Readiness and Content

Consumer readiness is understood in terms of basic factors like literacy, awareness, interest, and conviction. It also includes equal access for all genders to strive towards sustainable goals and for a holistic representation in the digital space.

According to GSMA, consumer scores are lower in the developing economies. This is due to the gap that exists between the user and the content provided on the cloud, assisted by economic and social determinants.

Consumers in emerging economies are striving to move higher in terms of financial capabilities and digital awareness. Not everyone has access to equal financial gains and opportunities due to unequal distribution of resources. Priorities and use cases vary across markets. Therefore, there is a significant disconnection between consumers and the content being circulated across networks.

Several users in the emerging markets misunderstand the internet as solely a medium of entertainment, thereby, remaining unaware of various functional services like e-governance, e-banking, mobile money, transportation, e-learning, etc. Many users lack necessary skills required to explore the internet. The process of browsing is further complicated by challenges posed by the unavailability of content in local language. Most consumers would instead browse in a native language.

Towards Holistic Digital Inclusion

Gathering from the report, we can conclude that infrastructure, affordability, consumer readiness, and content are the key foundation for digital inclusion.

Emerging markets have to be assisted with a systematic approach towards these enablers.

The user is always at the core of every initiative; hence, efforts must be made to understand the key drivers of their needs.

Along with strong, high-performing infrastructure, network providers and policy makers need to recognize the cultural environment of users, especially when it comes to women consumers. It is a known fact that most women in developing economies are still striving for equal access and income and without representing all groups across gender, race, class, etc. we cannot hope for a fair digital inclusion.

Finally, as a significant component, content primarily motivates and drives the user’s interest. Therefore, the focus must always rest upon its benefit and relevance.